Book Review of CRASHED: Real Money & Fairy Tale Economics

Crashed by Adam Tooze is a very long book about how we got into the Great Financial Crisis of 2008, how we muddled through it and why it is still with us. At times it reads like a financial and geopolitical thriller. Most of the time, however, Tooze tells his epic story the way it should be told – in long hand with numbers, graphs and plenty of detail. Just like a building cannot be built on instructions written on a napkin, the story of 2008, what went into it and all that sprung from it cannot be told in an abridged way. It makes sense. The “panic” of 2008 was all about “napkin” thinking. Not including the truly heroic figure of the Fed, nobody before or after seemed able to resist the greed, denial and political expediency that come with simplistic nostrums. The following are a few illuminating points made in a book that is a bit long and that loses its bite the closer it gets to the present. Regardless, the first half will convince you how true it is that we are all blind to the truths that lie directly before our eyes. Lately, I feel that much of history is about either reinforcing and restitching the curtain that we draw before us or is the act of drawing it open and revealing the humbling truths that lie within our reach.

I will resist going into the details of the 2008 panic itself and the subprime crisis that triggered it. This is well-trodden territory told well both in this book and elsewhere. Rather, I want to begin where Tooze does – the Clinton and early Bush years. It seemed we were all focused on the “wrong” crisis. I remember the obsession with our debt levels, the rise of China and the fear that our solvency was in the hands of the Chinese buyers of our sovereign debt. One of the principle reasons only the geeks of Michael Lewis Big Short world saw the 2008 panic coming was that we were looking overseas at the unreliable Chinese while ignoring the sinkhole being carved out underneath us by our “best & brightest.” It makes you pause. How often are we looking in the wrong direction? What is creeping up on us now as we hyperventilate about Trump, our borders, Iran and socialism? Maybe this partly explains the phenomena of “Game of Thrones”. We loved the show because it seemed we were always anticipating the wrong thing. It was employing a frightening human weakness and transforming it into an utterly seductive fantasy. The idea that the securities created by the subprime mortgage market were bullet proof, that a national real estate crash was not in the cards and that derivatives could ensure us in a worst case scenario all proved to be a part of a seductive world of financial fantasy bought into by all parties.

Tooze also provides further perspective on that international rogue player, Russia. He reminds us that Russia’s collapse after the fall of the Soviet Union was epic not only in its geopolitical realignment and the loss of vast parts of what was the Soviet empire, but the terrible price the country paid financially. By the mid-Nineties, 87% of Russian currency in circulation in the country was composed of dollars as the ruble had collapsed. Half the population was living at or below the poverty line. All this helps put in perspective the aggressive nationalism and profound resentment that marks today’s Russia and her efforts to return to the international stage as a superpower by hook or by “crook”.

Brexit and the Tea Party and much of the populist nationalism strutting the world’s stage got its start with 2008. The distribution of wealth created by the “boom” years after the fall of Communism was grossly distributed. In the 15 years leading up to the Crash, close to 90% of the western world’s wealth went into the hands of the top 1%. This is familiar. It has been verified many times. The conservative reaction, however, both here and particularly in the UK, however, was not to examine the inequality but was to blame government and government spending. The focus of the Tea Party and its brethren in the Tory Party in the UK was on trimming government spending – the very response guaranteed to make things even worse. As the Fed showed effectively in 2008, the solution was government and blaming it only deepened inequality. The truth of this terrible politically motivated deception can be seen today as populist President Trump rides a wave of economic growth stimulated by the very kinds of fiscal stimulus repeatedly demonized by the Tea Party and the conservatives in America and Europe. The nostrum that government should operate like a household budget is too often the nursery rhyme employed by the right when trying to gain a political edge at the expense of commonly accepted and proven economic principles. It was employed to devastating effect by Republicans back in 1937 when they forced FDR to cut back on government spending just as we were finding our way our out of the Great Depression. We sunk back into a “second” depression that only WWII could remedy. Tooze is pretty clear that the Brexit nightmare was not a product of EU policy or globalization or immigration; rather, it came because the Tory government wrapped itself around the self-immolation of unnecessarily severe austerity, killing the only golden goose that might have kept things together.

There is so much to think about in this vast book.

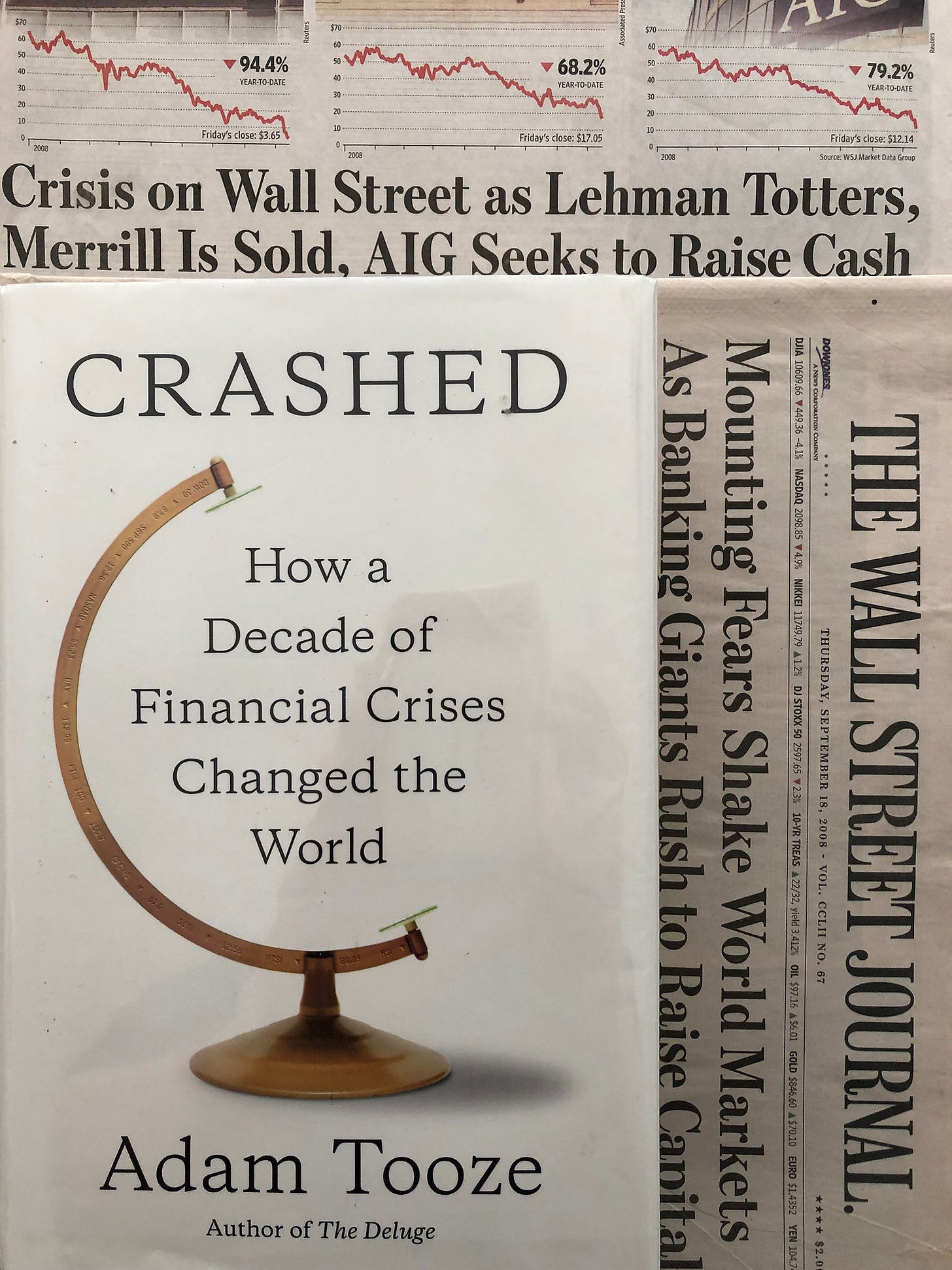

Crashed: How a Decade of Financial Crises Changed the World

by Adam Tooze (2018)

616 pages